China's FX Market Shows Resilience

Advertisements

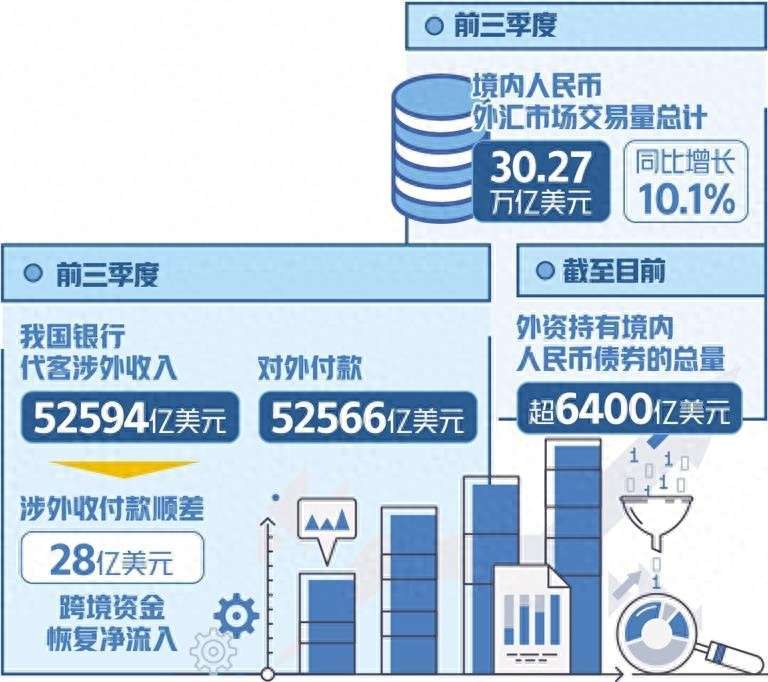

On October 22, a press conference was held to present data on China's foreign exchange balance for the first three quarters of 2024. According to the figures released, the State Administration of Foreign Exchange (SAFE) reported that throughout the year, foreign exchange receipts from clients at banks amounted to a notable $525.94 billion, while payments stood at $525.66 billion, resulting in a minor surplus of $28 million. Furthermore, a significant recovery in cross-border fund inflow was observed.

The foreign exchange market in China exhibited remarkable activity during this period. In the first three quarters, the total trading volume within the onshore RMB foreign exchange market reached approximately $30.27 trillion, an increase of 10.1% compared to the previous year. This volume comprises spot and derivative transactions amounting to $10.18 trillion and $20.09 trillion, respectively, with derivatives accounting for 66.4% of total trade—an impressive increase of 3.7 percentage points from the first three quarters of 2023.

Deputy Director of SAFE, Li Hongyan, highlighted that the Chinese foreign exchange market has showcased considerable resilience this year, with a stabilization trend observed recently. The RMB exchange rate has remained fundamentally stable amid two-way fluctuations, and the rational expectations and transactions in the foreign exchange market show orderly progress. The international payment balance is generally maintained at its fundamental equilibrium, providing a solid foundation for sustained stability in China's foreign exchange market moving forward.

A key characteristic of the current market is the renewed net inflow of cross-border funds. Data indicates that, during the first three quarters, there was a slight overall surplus in the foreign exchange transactions conducted by banks, beginning with a marginal surplus in the first quarter, shifting to a deficit in the second quarter, and then returning to a surplus in the third quarter. Notably, goods trade has continued to demonstrate net inflow, foreign investment in China shows promising trends, and domestic entities maintain orderly foreign investments.

Li Hongyan elaborated on the encouraging shift in international investment trends, stating that foreign asset allocation towards RMB-denominated assets has shown robust momentum recently. Since the beginning of this year, the comprehensive yields on RMB bonds have been consistently favorable, leading to increased foreign investment in these vehicles. Currently, foreign ownership of onshore RMB bonds exceeds $640 billion, reaching historical highs. Additionally, following a surge in domestic stock markets, foreign net purchases of onshore equities had further increased since late September, signifying a growing appetite for RMB asset allocation among international investors.

The current account balance has also remained in a reasonable surplus. Throughout the first half of the year, China's current account surplus reached $93.7 billion, accounting for 1.1% of the Gross Domestic Product (GDP) and remaining within a balanced range. Preliminary statistics for the third quarter indicate that the current account surplus remains at similarly reasonable levels.

Jia Ning, Director of the International Balance of Payments Department at SAFE, remarked on China's continuing advantage in its supply chains and production capabilities, which has enhanced its external trade competitiveness and stimulated the growth of productive service exports. Furthermore, the vast consumption potential of the Chinese market enables global trading partners to share in the growth opportunities presented by China's development, thus promoting a balanced expansion of the country's import and export activities.

Looking ahead, China is expected to experience steady growth in both exports and imports, resulting in a stable trade surplus. Jia observed that several factors contribute to this outlook: first, a mild global economic recovery continues to bolster external demand for Chinese exports. Second, the intrinsic momentum supporting export growth remains robust. On the import side, the ongoing upward trajectory of China's economic operations, fueled by a resurgence in consumer activity, is likely to increase international demand for goods. In recent years, proactive measures to facilitate greater importation into China have opened avenues for global markets to access the Chinese market, further driving the scale of imports.

Moreover, the structure of service trade balance is progressively improving, which might lead to moderated trade differentials in the future. China has been relentlessly advancing its industrial transformation to foster a deeper integration of the service sector with manufacturing, facilitating rapid development in high-end services such as the digital economy and intellectual property, leading to steady growth in service trade exports.

In response to widespread concerns regarding adjustments in monetary policies of major economies, the foreign exchange authority is enhancing its monitoring efforts. In September, the Federal Reserve announced a 50-basis-point rate cut, signaling a departure from its prolonged tightening policy, leading to some adjustments in interest differentials between China and the U.S. The future trajectory of Fed rate cuts remains uncertain, and market expectations are rapidly adapting in response to fluctuations in U.S. economic data.

Li noted that past experiences suggest that adjustments in the Fed's monetary policy will invariably exert spillover effects on global financial markets. Although exposed to some impacts, China's foreign exchange market has maintained stability, attributed largely to the robust support derived from China’s economic fundamentals.

Experts assert that enhancements in the market-oriented formation of the RMB exchange rate mechanism over recent years have augmented the automatic stabilizer function of exchange rate adjustments in international payments, thereby facilitating better responsiveness to external pressures. Companies have also become more proficient in utilizing foreign exchange derivatives to hedge against currency risks, along with a rising tendency to engage in cross-border RMB settlements to mitigate currency mismatches. These positive trends have alleviated the volatility in the foreign exchange market, thereby contributing to a more rational market outlook and trading behavior.

Moving forward, SAFE intends to intensify its market outreach and training initiatives, encouraging financial institutions to optimize their services and collaborate to reduce foreign exchange hedging costs. Efforts will also concentrate on deepening the development of the foreign exchange market and enhancing the financial infrastructure serving it, ultimately supporting enterprises in better managing their foreign exchange risks.